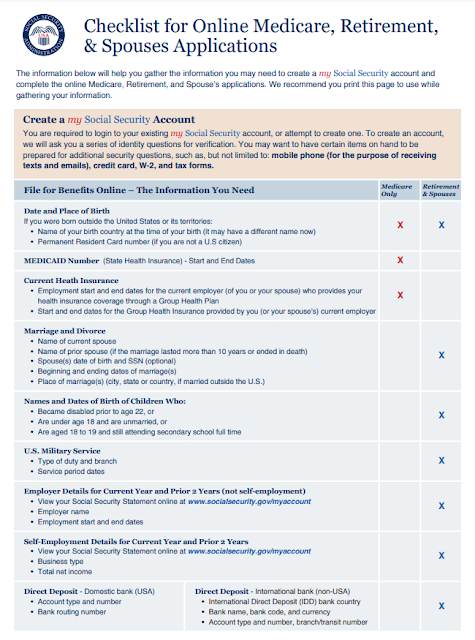

>>Click HERE for LARGER image or Printable Version>>

Friday, August 19, 2022

Friday, August 5, 2022

Is a Credit Freeze or Fraud Alert Right for You?

>> Click HERE to link to Federal Trade Commission for Additional Info >>

During Identity Theft Awareness Week 2022, we’ve talked about reducing your risk of identity theft. Credit freezes and fraud alerts can help. Both are free and make it harder for identity thieves to open new accounts in your name. One may be right for you.

During Identity Theft Awareness Week 2022, we’ve talked about reducing your risk of identity theft. Credit freezes and fraud alerts can help. Both are free and make it harder for identity thieves to open new accounts in your name. One may be right for you.

Credit freezes

A credit freeze is the best way you can protect against an identity thief opening new accounts in your name. When in place, it prevents potential creditors from accessing your credit report. Because creditors usually won’t give you credit if they can’t check your credit report, placing a freeze helps you block identity thieves who might be trying to open accounts in your name.

A freeze also can be helpful if you’ve experienced identity theft or had your information exposed in a data breach. And don’t let the “freeze” part worry you. A credit freeze won’t affect your credit score or your ability to use your existing credit cards, apply for a job, rent an apartment, or buy insurance. If you need to apply for new credit, you can lift the freeze temporarily to let the creditor check your credit. Placing and lifting the freeze is free, but you must contact the national credit bureaus to lift it and put it back in place.

Place a credit freeze by contacting each of the three national credit bureaus, Equifax, Experian, and TransUnion. A freeze lasts until you remove it.

Fraud alerts

A fraud alert doesn’t limit access to your credit report, but tells businesses to check with you before opening a new account in your name. Usually, that means calling you first to make sure the person trying to open a new account is really you.

Place a fraud alert by contacting any one of the three national credit bureaus. That one must notify the other two. A fraud alert lasts one year and you can renew it for free. If you’ve experienced identity theft, you can get an extended fraud alert that lasts for seven years.

Learn more about credit freezes, fraud alerts, and active duty alerts for service members. And, if identity theft happens to you, visit IdentityTheft.gov to report it and get a personal recovery plan.

The Attorney General's Elder Hotline

>>Click HERE to link to Mass.gov for additional info>>

The Attorney General’s Elder Hotline

The Attorney General’s Office has a statewide, toll-free hotline to help elders with a range of issues.

Call the Elder Hotline at (888) AG-ELDER or (888) 243-5337. TTY: (617) 727-4765.

The Elder Hotline is open Monday through Friday from 10:00 am to 4:00 pm. The hotline is staffed by senior volunteers\

How the Elder Hotline can help you

Senior volunteers with the Elder Hotline can help you find answers to your questions, resolve disputes with businesses, and assist with other issues including:

- Abuse and exploitation of elders

- Debt and debt collection practices

- Health insurance

- Home improvement

- Landlord, tenant, and housing issues

- Long-term care

- Identity theft and scams

- Retail disputes

- Telemarketing

Get Consumer Support

Read about getting consumer support at the Attorney General's Office for more information on how we can help you.

In addition to calling the Elder Hotline, you can file a consumer complaint online with our office.

Monday, August 1, 2022

Massachusetts Emergency Management Agency | Emergency Preparedness Guide | Be Informed - Make A Plan - Build A Kit - Get Involved

This information is being shared by Peabody TRIAD in honor of National Preparedness Month. The Peabody TRIAD Council consists of Seniors and Law Enforcement working together to develop and implement policies and programs to reduce criminal victimization, promote crime prevention and safety awareness, and serve the needs of the senior community in Peabody. In addition, the Council designs and supports programs to improve the quality of life for our senior citizens. The Peabody TRIAD Council believes they have the ability to make a difference in our community and are dedicated to serving our city and its residents.

>>Click here for Printable Version or to read publication>>

Know Plan Prepare: Preparedness Checklist

This

information is being shared by Peabody TRIAD in honor of National Preparedness Month. The Peabody TRIAD Council consists of Seniors and Law

Enforcement working together to develop and implement policies and

programs to reduce criminal victimization, promote crime prevention and

safety awareness, and serve the needs of the senior community in

Peabody. In addition, the Council designs and supports programs to

improve the quality of life for our senior citizens. The Peabody TRIAD

Council believes they have the ability to make a difference in our

community and are dedicated to serving our city and its residents.

Checklists provide essential information to help you and your family prepare yourselves for an emergency. Find the right checklist for you.

You can use the online fillable PDF form to enter your family’s information. Once completed print copies and share it with all family members. Select your language below.

Additional checklist items during the COVID-19 pandemic: during any pandemic, there are additional items to add to your checklist and in your emergency kit. Please review this toolkit from American Red Cross: Preparing for Disaster During COVID-19 and review Ready.gov/kit to find additional guidance that may fit your needs.

Table of Contents

>>Click HERE for Printable Version or to read publication>>

Subscribe to:

Posts (Atom)