Tuesday, May 24, 2016

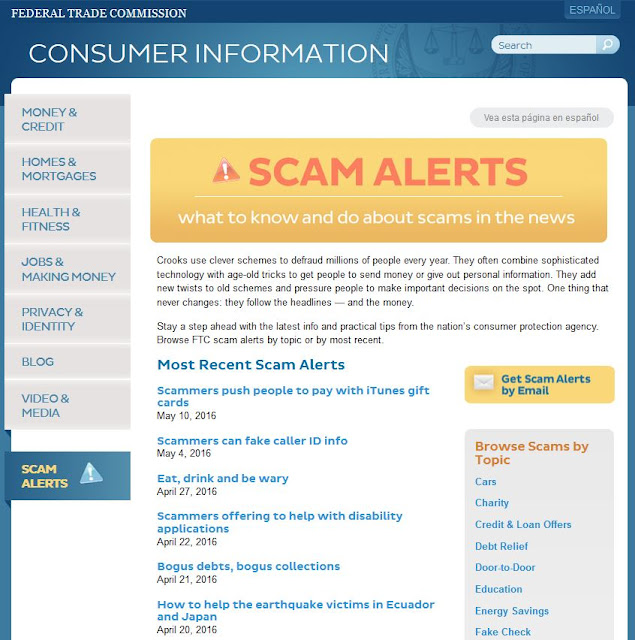

FEDERAL TRADE COMMISSION - CONSUMER INFORMATION - SCAM ALERTS

Elder Affairs is often reminded of new (and sometimes old) ingenious practices to separate elders and others from their money - either outright or through information that seniors provide in good faith.

The Federal Trade Commission (FTC) maintains a constantly updated website to alert consumers about what's real and what's fake.

>>Click HERE to link to the Federal Trade Commission - Consumer Information>>

Friday, May 20, 2016

Subscribe to:

Posts (Atom)